FLIP Genesis Tokeneconomics

This page outlines the original tokenomics of FLIP prior to 2023.

While these allocations and schedules remain relevant for historical reference, the latest tokenomics snapshot, including updated distributions and mechanics, can be found here.

This page is intended to display accurate information regarding the tokenomics of FLIP just before the TGE so that analysts can have access to that data. Of course, once live, the listed schedules remain in effect until all conditions have been passed.

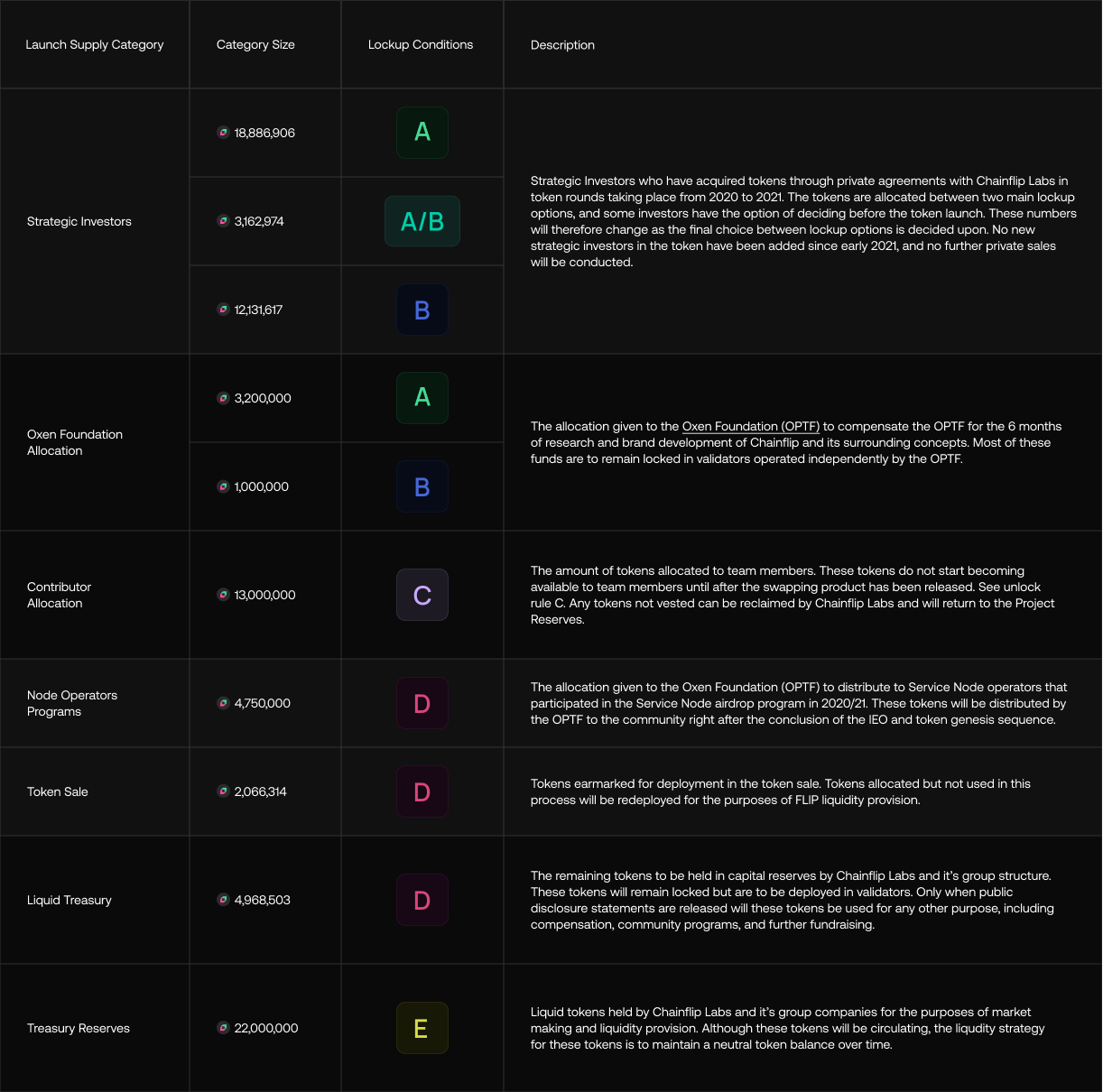

Genesis Supply Distribution

There are a few different lockup rules for different parties in the Chainflip Ecosystem. The terms of the lockup conditions are described as:

A - Validator Lockup

Lockup Tokens are deposited into a smart contract which prevents transfers for 365 days. However, the contract still allows the holder to interact with the StakeManager contract, allowing them to stake these tokens into Validators during the lockup period.

B - Linear Lockup

Tokens are deposited into a smart contract which releases 20% of the tokens after the conclusion of the TGE. The remaining tokens can be claimed linearly over the next 365 days.

C - Contributor Vesting

These tokens remain completely locked until certain conditions are met by the start of a month after the successful launch of the Chainflip Swapping Protocol. When this has been achieved, the tokens can start to be claimed, with some contributors able to claim 10% and others receiving 20%. The remaining tokens can be claimed linearly over the following 2 or 3 years, depending on how long that contributor has been a part of the project. Some also received the option to claim 5% at TGE.

D - Unlocked

Tokens with no restrictions applied to them upon distribution.

E - Reserved

Tokens locked indefinitely in the project treasury, used exclusively in Validators unless otherwise announced in disclosure statements.

Allocations & Lockups

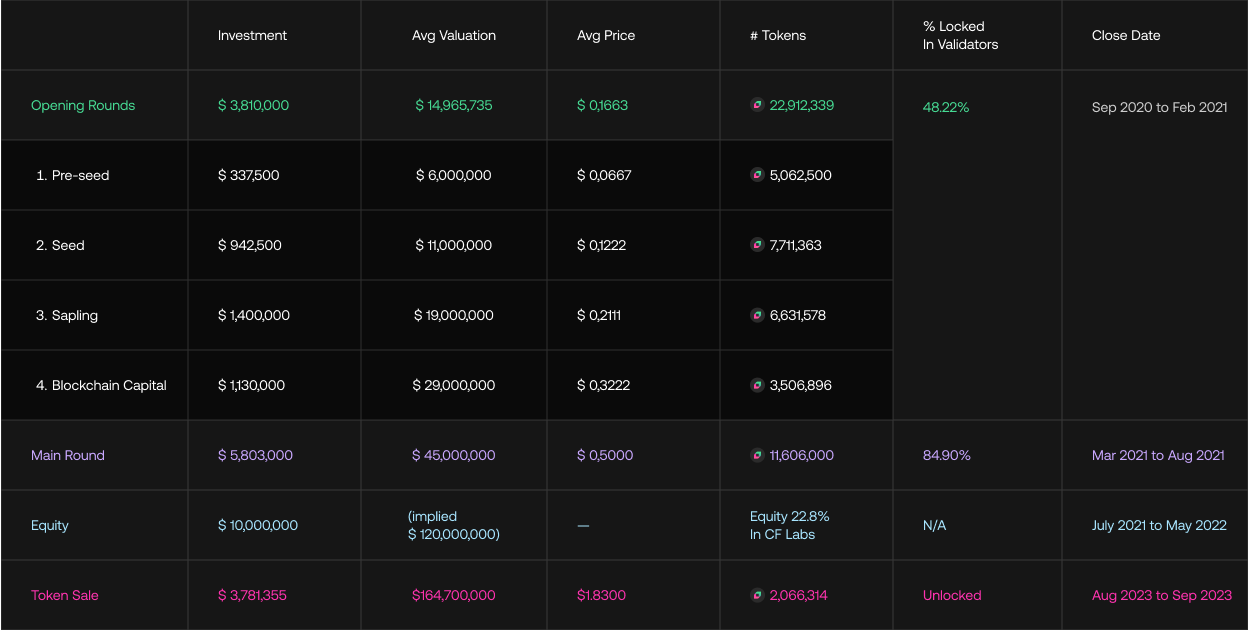

Investment Rounds Overview

Chainflip has undergone multiple funding rounds, raising a total of $23.3m. These rounds were conducted through a series of rounds, all of which are detailed below.

Fundraising began with a series of investments from late 2020 and closed in February 2021, for $3.81m at approximately $15m valuation. This round was led by Blockchain Capital and other notable names such as Mechanism Capital, Apollo Capital, CMS Holdings, DACM and more.

The main round took place shortly afterwards and closed in August 2021, raising $5.80m at a $45m valuation. Notable names leading this round include Framework, Coinbase Ventures, Hypesphere, Delphi, Morningstar Ventures, EdenBlock, MetaCartel, Lemniscap, Defi Alliance and more.

Our most recent round was an equity round for $10m at an equity valuation of $45m in May 2022, with an implied token valuation of \$120m. Pantera Capital, Framework Ventures and Blockchain Capital were the buyers. Unlike the token rounds, investors are committed for 5 years and can redeem their shares for a share of the treasury instead of a direct token warrant.

Many investors have signed additional terms that require them to run validator nodes or provide liquidity, and are required to actively manage these positions with a performance clause. An example of such a clause would be to run 2 validator nodes, without any prolonged downtime, for the entirety of an investors lock up period.

Finally, Coinlist users purchased $3.78m worth of tokens during the public sale that ran accross August and Septmeber of 2023.

On the 23rd of November, 2023, the FLIP token went live, closing off the pre-genesis fundraising. Future equity and token fundraising may take place in the future, though nothing is planned at this time.