Getting Started

There are a few things that are different when it comes to cross-chain swapping at Chainflip.

The most notable difference is the absence of slippage tolerance or guaranteed minimum amount to be received. This is due to the just-in-time liquidity nature of the JIT Chainflip AMM. Liquidity is actively deployed by LPs as they monitor upcoming swaps in the protocol.

Our Swapping application displays a quoted rate from LPs, which is the best estimate at that time given the current liquidity — both deployed and undeployed. The difference between this rate and the global index price — which we get from Coingecko — is what we call the price delta.

You can learn in detail about the Swapping Basics at the protocol level.

Sending funds: Deposit Channels

We make use of deposit channels to ingress funds into the protocol. A deposit channel is tied to a deposit address and provides an incredible flexibility to the user for the following reasons:

- No specific wallet required

- A simple (and cheap) token transfer

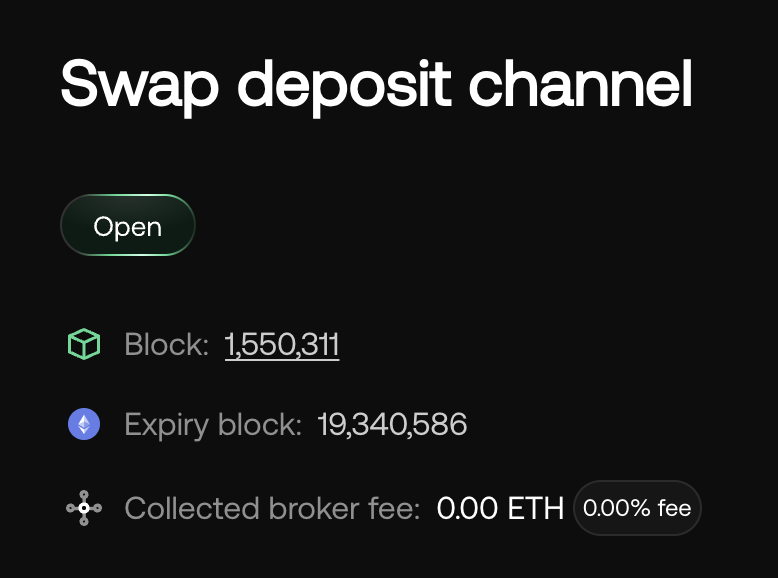

To achieve this, a service called the Broker is responsible for opening a deposit channel on behalf of users. The resulting deposit channel (and address) is associated with the swap details and the destination address. This information can be verified using our Block Explorer (opens in a new tab).

All frontend applications need to interact with a Broker service, which means that any project looking to integrate Chainflip must run their own Broker.

You can learn more about how Deposit Channels and Brokers work in detail.

Once the deposit address is ready, send your funds while the channel is open, otherwise your funds may be lost!

Deposit channels expire after 24 hours. As a security measure, the Swapping application will hide the deposit address approximately one hour before it expires. However, if the address expires, you can always request a new one.

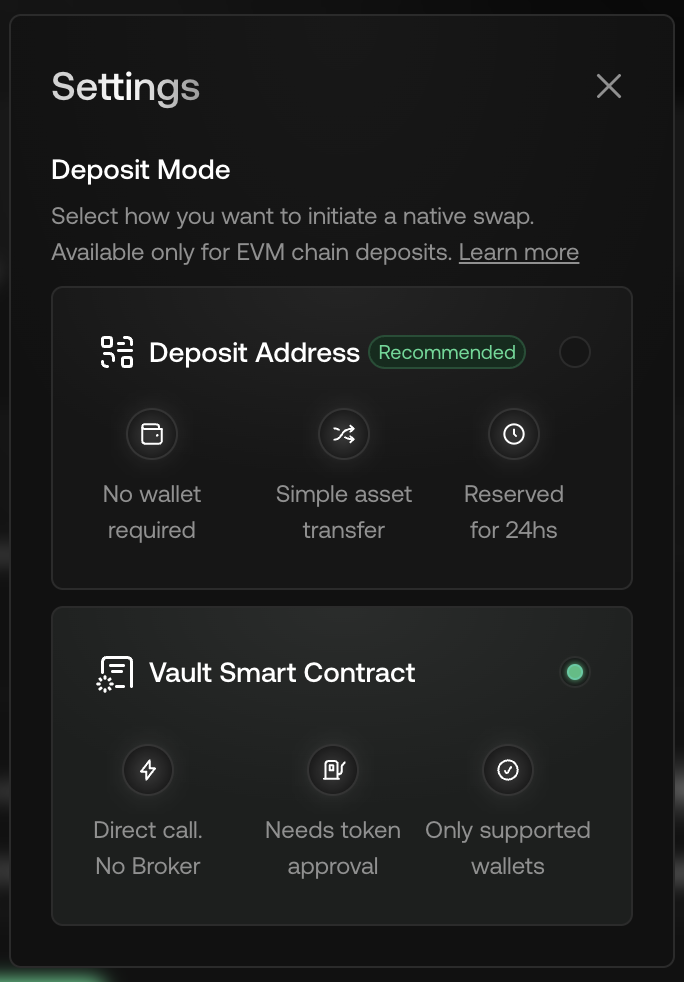

Vault Smart Contract Call (EVM only)

This method is only available for EVM chains

Alternatively, you can connect your Ethereum wallet, as a swap can also be triggered by calling the swap() function in the Vault smart contract.

This offers a higher level of control, as you don't need to interact with a Broker. However, it does require an additional transaction for token approval, which results in more gas being consumed.

In the swapping app, you can go to Settings and enable "Vault Smart Contract" calls by default to avoid using deposit channels.

Deposit Caps

These are the current maximum deposit amounts for this pre-release:

| Asset | Amount |

|---|---|

| ETH | 22 ETH |

| USDC | 50000 USDC |

| FLIP | 10000 FLIP |

| BTC | 1,2 BTC |

| DOT | 7500 DOT |

These deposit caps are in place for pre-release only. Once we officially launch, they will be removed.

Minimum Deposit Amounts

Deposits below the minimum amount will be ignored and are effectively burned. These are the current minimum deposit amounts:

| Asset | Amount |

|---|---|

| ETH | 0.01 ETH |

| USDC | 20 USDC |

| FLIP | 4 FLIP |

| BTC | 0,0007 BTC |

| DOT | 4 DOT |

Platform Fees

This section covers all the fees involved in a Chainflip swap.

Broker Fee

As mentioned above, the role of the Broker is to open deposit channels on behalf of users. To do this, Brokers must pay a small amount in $FLIP to cover gas and a Channel Fee. This is a network security mechanism to prevent spam.

In the case of our Swapping app, the Broker fee is zero. However, projects integrating Chainflip may choose to charge a fee for the use of their Broker service, to offset the cost of running it.

The fee can be set at any value between 0 bps and 1000 bps and can verified in the Block Explorer.

Here is an example (opens in a new tab):

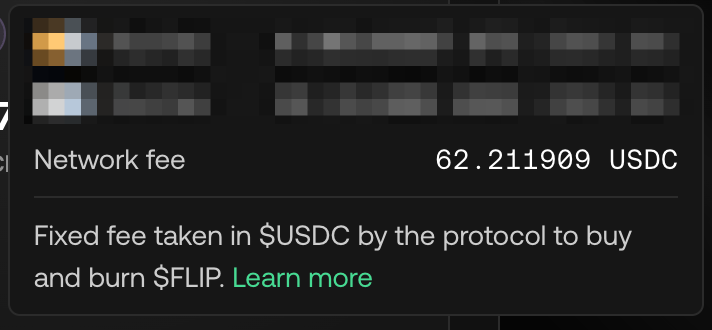

Network Fee

The most important fee in the protocol as it is a part of the burning mechanism. The network fee is taken only once per swap, regardless of the pools (legs) involved, and used to buy $FLIP. This $FLIP is then burned forever.

The current value of the fee is 0.1%. Learn more about the impact of the Network Fee (opens in a new tab).

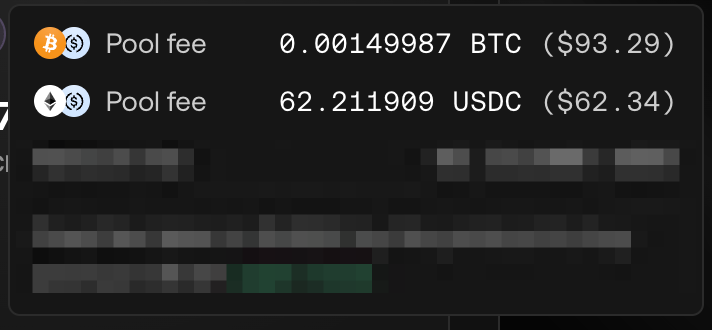

Liquidity Provider Fee

Learn more about how Liquidity Provider accounts work.

A fixed liquidity fee is charged for each pool. Liquidity providers collect these fees from the positions they actively manage. This is referred to Deployed liquidity and each liquidity provider can be verified in our Explorer.

The current values are:

| Pool | Fee |

|---|---|

| BTC/USDC | 0.15 % |

| ETH/USDC | 0,10 % |

| FLIP/USDC | 0.10% |

| DOT/USDC | 0.10% |

Gas Fee

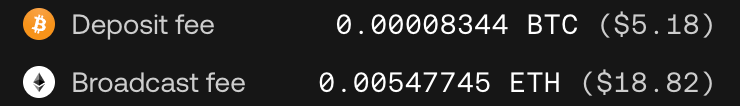

This fee refers to the State Chain gas involved during the processes of Ingress and Egres of funds in the protocol.

-

Deposit Fee: In order for Chainflip to allow users to send funds to a regular deposit address, the protocol must estimate the cost and deduct a fee for each deposit, as this will cost gas for most chains and assets this costs gas.

-

Broadcast Fee: Similarly, to send the swapped funds to the destination address, the protocol must estimate and deduct a fee to cover the gas of sending funds to the destination chain.

Supported Wallets

The Chainflip Swapping app uses Rainbow Kit (opens in a new tab) to manage wallet integrations. The following wallets are currently enabled:

- Metamask

- XDEFI Wallet

- Rainbow

- OKX Wallet

- Wallet Connect

- Coinbase Wallet

- Rabby Wallet

- Subwallet

- Talisman

Supported Assets and Chains

As of today, the Chainflip protocol supports the following assets and chains:

| Asset | Chain |

|---|---|

| BTC | Bitcoin |

| ETH | Ethereum |

| USDC | Ethereum |

| FLIP | Ethereum |

| DOT | Polkadot |

Once aggregation is enabled, the swapping app will support thousands of assets on over 30 chains.

Stay tuned for our Discord announcements (opens in a new tab).